Why You Need an Emergency Fund: Protecting Your Financial Future

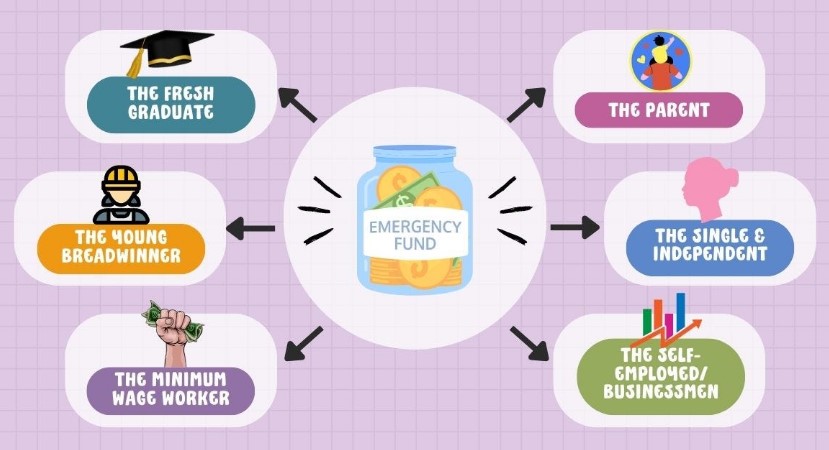

Life is full of surprises. Some are pleasant, like a job promotion, while otherssuch as car repairs, sudden medical bills, or job losscan create financial stress. An emergency fund acts as a buffer, giving you peace of mind when unexpected expenses arise. It's not just about having extra cash lying around; it's about taking control of your financial security.

An emergency fund is a specific pool of money set aside to cover urgent expenses without derailing your long-term savings or plunging you into debt. In this article, well explore why its essential to have an emergency fund, how to start building one, and tips to maintain and grow your savings effectively.

What Is an Emergency Fund?

At its core, an emergency fund is a safety net. It's a sum of money reserved strictly for emergenciessituations where you need immediate access to funds but don't want to dip into your regular savings or take on debt. These funds are not to be used for vacations, dining out, or buying new gadgets. They are strictly for unforeseen financial hardships.

A robust Emergency fund can give you time and space to handle unexpected events calmly. It keeps you from feeling pressured to make rushed decisions, like borrowing money at high interest rates or selling important assets. It provides a sense of financial security, enabling you to focus on solving the problem rather than scrambling to find money.

Why Is an Emergency Fund Essential in 2024?

Financial stability has become more important than ever, especially in an unpredictable global environment. With rising costs of living, potential job instability, and economic shifts, 2024 is a year where personal finance should be a top priority. Whether its inflation affecting daily expenses or the fear of an economic downturn, having a cushion to fall back on can make a massive difference.

Even if your job feels secure right now, circumstances can change quickly. Beyond that, emergency medical situations, car repairs, or urgent home maintenance can add financial strain. Without an emergency fund, you may be forced to take out high-interest loans or rack up credit card debt to cover these expenses, setting you back financially for years to come.

Starting Your Emergency Fund

Building an emergency fund can seem daunting, but breaking it down into smaller steps makes it easier. Start with these strategies:

Set a Savings Goal

The first step is identifying how much you need. As mentioned earlier, aim for three to six months of essential expenses. If youre unsure how much that is, take a look at your current monthly budget and note what you spend on essentials like rent, groceries, and bills.

Start Small and Stay Consistent

Its okay if you cant save a large amount right away. The key is to start saving something, even if its just a few dollars a week. Over time, small amounts add up. Consider setting up automatic transfers from your checking account to your savings account to make the process hassle-free.

Cut Back on Non-Essential Spending

One of the easiest ways to free up money for your emergency fund is to trim unnecessary expenses. Take a look at your spending habits and see where you can make small changes. Perhaps its cutting back on takeout, reducing subscription services, or finding more affordable ways to entertain yourself.

Side Hustles or Extra Income

If youre struggling to save with your current income, finding ways to earn extra money can speed up the process. Consider taking on freelance work, selling items you no longer need, or leveraging your hobbies to create income streams.

Where to Keep Your Emergency Fund?

Accessibility is key when it comes to an emergency fund. You want to keep the money in a place where you can access it quickly but not so easily that you're tempted to use it for non-emergencies.

Many people opt to keep their emergency funds in a high-yield savings account. These accounts often offer better interest rates than traditional savings accounts, helping your money grow while still being easily accessible. It's also a good idea to keep this account separate from your regular checking and savings accounts, so you're not tempted to dip into it.

Avoid tying your emergency fund up in investments like stocks, which can fluctuate in value and may not be easily accessible during a market downturn. The priority is safety and liquidity, not high returns.

Rebuilding Your Emergency Fund After Use

If you find yourself in a situation where youve had to dip into your emergency fund, dont panic. The most important thing is that the fund was there to help when you needed it. After the crisis is over, focus on rebuilding your fund. Treat this replenishment as a priority and start contributing as soon as possible. Going back to your savings habitssuch as cutting back on spending or taking on extra workcan help you rebuild faster.

Avoiding Common Pitfalls

Many people struggle to build or maintain an emergency fund for a few reasons. One of the most common issues is not treating it as a priority. If you dont make regular contributions to your emergency fund, its easy to neglect it. Consider automating your savings to ensure youre consistently contributing.

Another pitfall is raiding the emergency fund for non-emergency expenses. Its tempting to dip into the fund when unexpected opportunities come up, like a last-minute vacation or a big sale. But its important to keep the purpose of the fund in mind. Discipline is key to maintaining your financial security.

Finally, don't rely on credit cards as a substitute for an emergency fund. While credit can help in a pinch, high interest rates can quickly spiral out of control, leaving you worse off than before. The goal of an emergency fund is to avoid debt, not to take it on.

Conclusion

Building an emergency fund is one of the smartest financial decisions you can make. It ensures that you're prepared for whatever life throws at you without derailing your long-term financial goals or sinking into debt. By starting small, making consistent contributions, and keeping your fund in a safe and accessible place, you can create a strong financial safety net that will serve you well in 2024 and beyond. Prioritize your financial security today, and you'll be better prepared for whatever the future holds.